How to apply for PAN Card for your Church?

Home » How to apply for PAN Card for your Church?

Table of Contents

A PAN (Permanent Account Number) card is essential for any church, that wish to carry out financial transactions in India.

PAN is used for opening a bank account in the church’s name, tax purposes and helps to track the financial dealings of the entity.

Church Management in India comes with its own set of challenges and if your church does not yet have a PAN card, this guide will help you understand how to apply for one easily.

Why Does Your Church Need a PAN Card?

1. Compliance with Tax Laws

Any organization, including religious institutions, must have a PAN to comply with tax regulations as per as per the Income Tax Act, 1961.

2. Opening a Bank Account

A PAN Card is required for opening a bank account in the name of the church in accordance with the RBI Guidelines vide circular number RBI/ 2015- 16/ 39/ DBR. No. Dir. B.C.7/13.03.00/2015-2016)

3. Financial Transparency

A Permanent Account Number (PAN) is critical for ensuring transparency and accountability in church financial transactions.

4. Tax Exemptions

Churches are eligible for income tax exemptions, a PAN is mandatory to claim those benefits.

Documents Required to Apply for a PAN Card for Your Church

Make sure to gather these documents before starting the application process:

1. Certificate of Registration of the Church

Make sure to gather these documents before starting the application process. This proves the existence of your Church. It could be:

- Society Registration Certificate, if your church is registered under the Societies Registration Act.

- Trust Deed, if your church is registered as a public trust.

- If not registered, a simple Memorandum of Association with Byelaws may also be used for PAN application.

2. Address Proof (any one of the following)

- Copy of the registration certificate that shows the official address of the church.

- Recent utility bill (electricity, water, telephone) in the name of the church.

Easy-to-use Church Accounting Software

Designed for Church Accountants and Secretaries

Steps to Apply for a PAN Card for Your Church

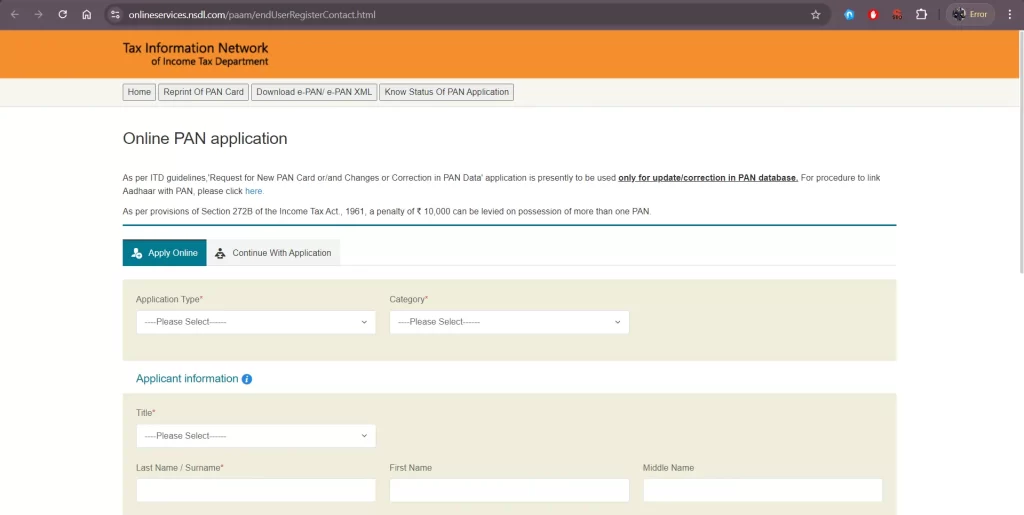

The application form to apply for a PAN card is Form 49A. You can either fill it online or download it from the PAN service websites (NSDL or UTIITSL).

Step 1: Fill Out Form 49A

The application form to apply for a PAN card is Form 49A.

- Go to the official PAN service provider’s website (NSDL or UTIITSL).

- Choose Form 49A (for Indian entities) from the forms section.

- Under the applicant type, select Association of Persons (Trust).

- Fill in all the necessary details like:

- Name of the Church: The official registered name.

- Address: Official church address.

- Date of Incorporation: Date when the church was registered as a trust or society.

- AO Code: This will be based on your location, which can be found on the PAN website.

Step 2: Submit Documents and Application

You can either submit your application online or offline:

- Online Submission:

- Upload scanned copies of the required documents.

- Pay the processing fee via net banking, debit/credit card, or demand draft.

- After submitting the form, you’ll receive an acknowledgment receipt. Keep this safe for reference.

- Offline Submission:

- Download the filled form, print it, and attach the photocopies of your documents.

- Send the application form along with the documents to the NSDL or UTIITSL office by post.

Step 3: Verification Process

Once the application is submitted, the authorities will verify the documents. This process usually takes 10-15 working days. If everything is in order, your application will be approved.

Step 4: Receive Your PAN Card

After successful verification, your church’s PAN card will be mailed to the official address you provided. This process usually takes around 15-20 working days.

Need Help?

If you find the process confusing or don’t have the time to handle the paperwork, you can always seek assistance from a Chartered Accountant (CA) who specializes in these procedures. A CA can help you with the form filling, documentation, and submission.

Alternatively, you can contact us for support or by reaching out at 9402679388/ 7005426278. We offer assistance to churches that need help with their PAN card applications, making the process quick and hassle-free.

Key Points to Remember

- Ensure that the name and details on the application form match the church’s registration documents.

- Double-check the documents to avoid any delay in the verification process.

- A PAN card will be issued in the name of the church, not an individual.

Our Latest Insights on Church Management & Technology.

Get Your Updates Instantly.

Churches in Northeast India are turning to digital tools, from livestreams to apps, to strengthen community connections, engage young congregants and improve church administration. This shift is transforming worship, outreach, and administration in ways that were once unimaginable.

Churches in Northeast India are turning to digital tools, from livestreams to apps, to strengthen community connections, engage young congregants and improve church administration. This shift is transforming worship, outreach, and administration in ways that were once unimaginable.

In catering to the youth of this generation, the church must bear in mind that this generation possesses information at their fingertips in unprecedented ways.

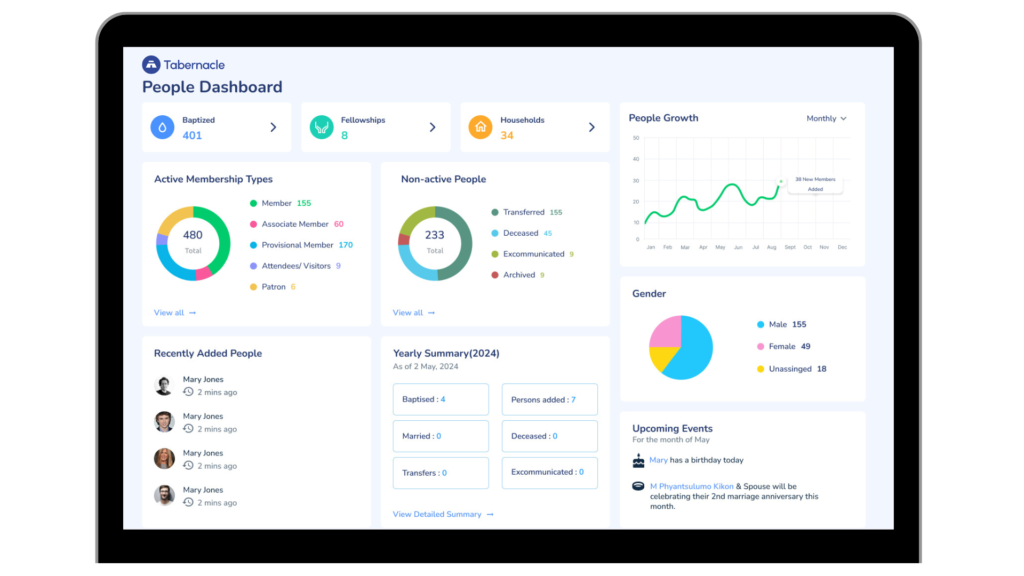

Looking for a Software to manage

your church?

We'd love to have you try our software!